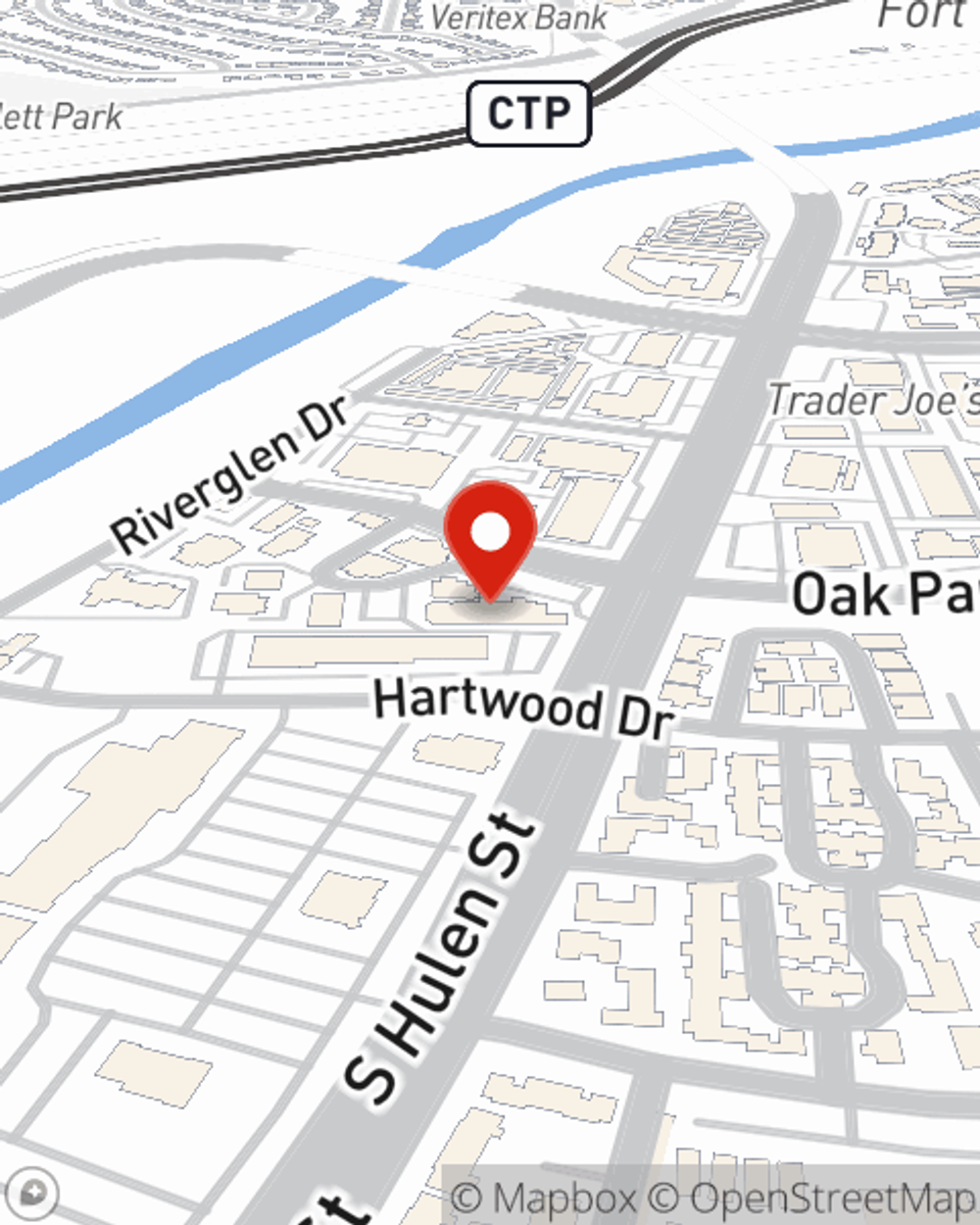

Business Insurance in and around Fort Worth

Looking for small business insurance coverage?

Insure your business, intentionally

- FORT WORTH

- TCU

- BENBROOK

- ALEDO

- WILLOW PARK

- WEATHERFORD

- WHITE SETTLEMENT

- RIVER OAKS

Business Insurance At A Great Price!

You've put a lot of time into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a home cleaning service, a hearing aid store, a hair salon, or other.

Looking for small business insurance coverage?

Insure your business, intentionally

Insurance Designed For Small Business

When one is as committed to their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for worker’s compensation, business owners policies, surety and fidelity bonds, and more.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Earl Wood's team to identify the options specifically available to you!

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Earl Wood

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?